tax per mile reddit

A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile. The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your Doordash and other deliveries for the 2020 tax year 56 cents per mile for the 2021 tax.

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

54 cents per mile for business miles driven.

. The infrastructure bill includes 125 million to fund. Simply put if you drive a vehicle you would pay money to the. I imagine if this is ever implemented even though we dont get to write off the miles we drive as employees for the.

54 cents per mile for business miles driven. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. June 4 2019 154 PM.

56 cents per mile driven for business use down 15. The timing of a vote on a 12 trillion infrastructure package divided House. Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc The rate for business travel expenses has dropped from 575 cents per mile in the.

Yes you need to pay tax if you drive for Lyft Uber or similar companies like Uber Eats and other ride-share companies. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021.

A pilot program to create a system for taxing drivers based on their vehicle mileage was slipped into Section 13002 of the legislation entitled National motor vehicle per. Search all of Reddit. When my electric car hating state first did it it was 400 per year.

Youre not going to get audited. I imagine if this is ever implemented even though we dont get to write off the miles we drive as employees for the 060mile that businesses can write off Id think thered be mileage tax. Conversely Italy reinforced its commitment to an electric future by distributing 650M 688M USD in tax breaks to electric vehicle customers from 2022 to 2024.

I figured up the equivalent gas tax from our Honda Civic Hybrid and that amount was way more than my real. A vehicle mileage tax or vehicle miles traveled fee would charge motorists a fee based on how many miles they drive. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a.

The Absolute Best Doordash Tips From Reddit Everlance

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

Traffic Why It S Getting Worse What Government Can Do

Editorial Biden Brings Back Road Usage Tax Plan

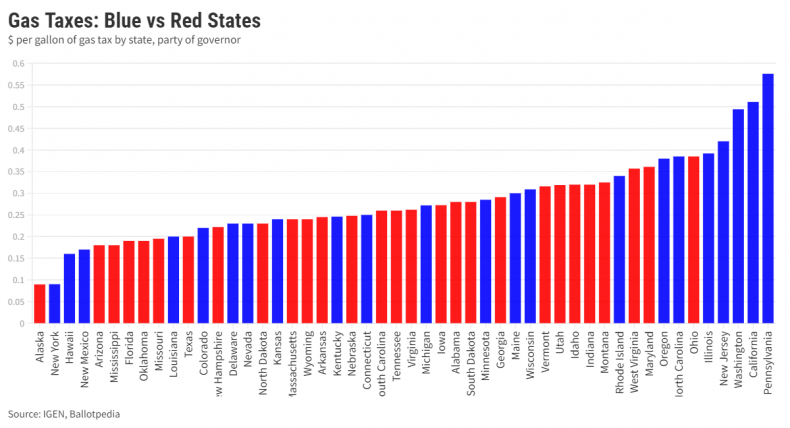

Gas Taxes Are Higher In Blue States Than Red Here S How And Why

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

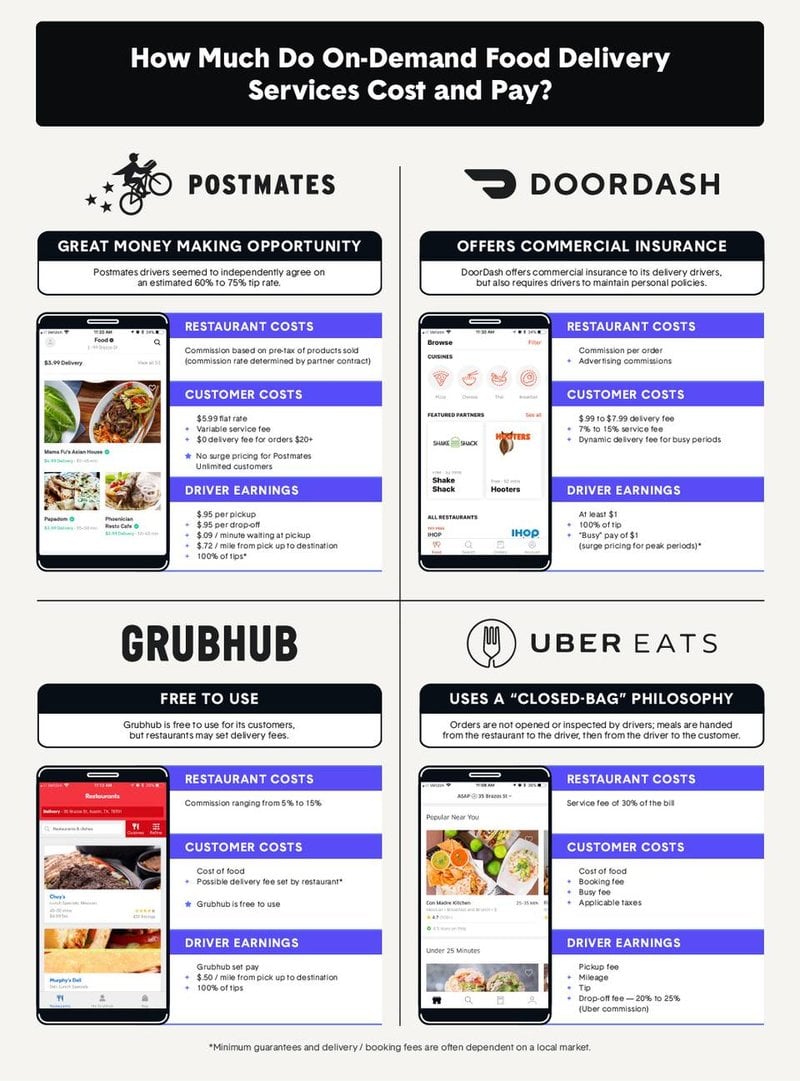

Postmates Doordash Ubereats And Grubhub A Comprehensive Comparison

How Much Money Have You Made Using Doordash Quora

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/69847422/1233506003.0.jpg)

How To End The American Dependence On Driving Vox

Platform Advertising Citap Digital Politics

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

The Great Fake Child Sex Trafficking Epidemic The Atlantic

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

How My Dad Got Scammed For 3 000 Worth Of Gift Cards The Hustle

The Absolute Best Doordash Tips From Reddit Everlance

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos